Irs Schedule E 2024 Form – The IRS typically tells taxpayers it will take 21 days to receive their refund after filing. However, that time frame can be shortened to two weeks by making minor adjustments to how you file, . When it comes to receiving your tax refund, timing varies based on several factors. According to the IRS, most refunds are issued within 21 days, but certain situations can cause d .

Irs Schedule E 2024 Form

Source : www.noradarealestate.comMastering Schedule E: Tax Filing for Landlords Explained

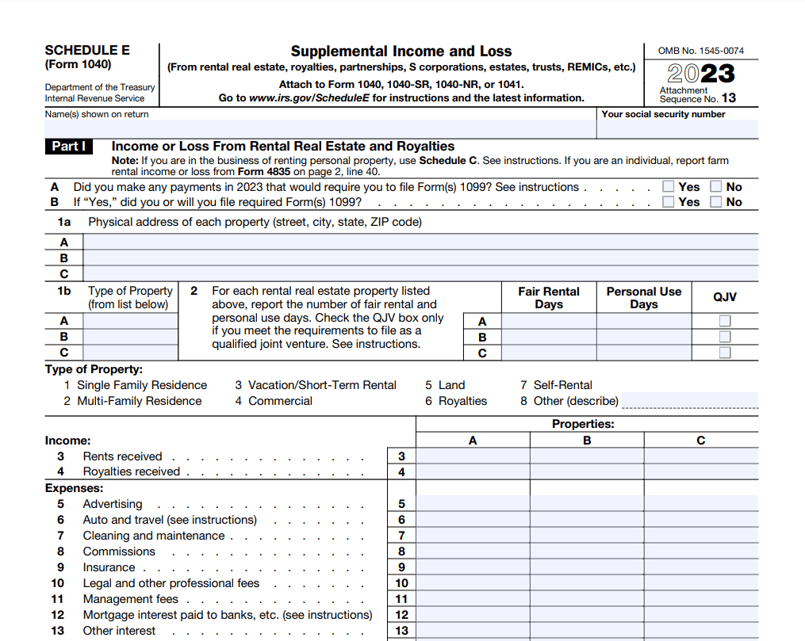

Source : www.turbotenant.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

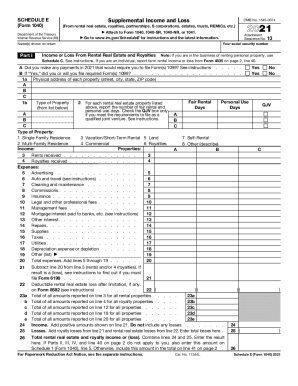

Source : www.therealestatecpa.comIRS 1040 Schedule E 2021 2024 Fill and Sign Printable Template

Source : www.uslegalforms.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.comE1204 Form 1040 Schedule E Supplemental Income and Loss (Page 1

Source : www.greatland.comSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.comAbout Schedule E (Form 1040), Supplemental Income and Loss

Source : www.irs.govSchedule E Form 1040 Line 11 The Bear Comic : r/comics

Source : www.reddit.com2023 Schedule E (Form 1040)

Source : www.irs.govIrs Schedule E 2024 Form Schedule E Instructions: How to Fill Out Schedule E in 2024?: If you haven’t filed your taxes yet, here’s why you may want to hold off if you’re claiming the child tax credit this year. . The earned income tax credit directly reduces the amount of income tax owed by lower-income working taxpayers. Depending on a tax filer’s number of children, tax filing status, and income, the tax .

]]>