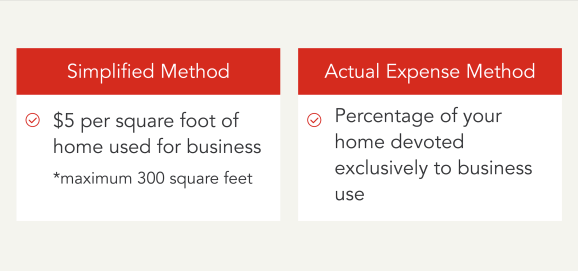

Home Office Deduction 2024 – If you worked remotely in 2023, you may be curious about the home office deduction. Here’s who qualifies for the tax break this season, according to experts. . But can the remote work setup also include tax deductions on your home office space? It depends. The biggest WFH tax deduction is arguably the home office deduction, and according to CNBC .

Home Office Deduction 2024

Source : blog.taxact.com2024 Tax Tips: Home office deduction

Source : www.cnbc.comHome Office Deduction for Small Business Owners | Castro & Co. [2024]

Source : www.castroandco.com2024 Tax Tips: Home office deduction

Source : www.cnbc.comHome Office Tax Deduction 2024 Blog Akaunting

Source : akaunting.comHome Office Deduction During Covid: 2024 Update

Source : www.autonomous.aiIRS announces 2024 income tax brackets – see where you fall

Source : news.yahoo.com5 Tax Traps for Claiming a Home Office Deduction Barbara Weltman

Source : bigideasforsmallbusiness.comAutonomous Insights

Source : www.autonomous.aiDo I Qualify for the Home Office Deduction? Intuit TurboTax Blog

Source : blog.turbotax.intuit.comHome Office Deduction 2024 Home Office Tax Deduction in 2024 New Updates | TaxAct: To be entitled to deduct home-office expenses, you must be required to use a part of your home for work. The CRA has confirmed that the requirement to maintain a home office need not be part of your . Working from home (commonly abbreviated as WFH) can offer a number of perks, from skipping the daily commute to wearing sweatpants all day long. But can the remote work setup also include tax .

]]>